Russia resumes coal supplies to Asia via North Sea route

After a three-year hiatus, Russian coal exporters have resumed delivering coal from Baltic Sea ports to the Asia-Pacific region via the Arctic Ocean via the Northern Sea Route (NSR), also known as the Arctic shipping lane, according to information released on August 10 by Russian analytical agency CCA Analytics.

In July, the 106,000-ton Admiral Schmidt departed Ust-Luga for the Chinese port of Caofeidian - the first ship to do so since 2021. This is the first coal to be transported via this route since 2021.

Shipments from Russia via the North Sea route have become increasingly important due to the increased risk of shipping through the Red Sea as a result of attacks by the Yemeni Houthis. Red Sea attacks have led to the “global navigator” (Transworld Navigator) ship damage, but also make tens of thousands of tons of Russian coal carrying the “tutor” (Tutor) dry bulk carrier sank in June.

In addition, other factors favoring the North Sea Route NSR include high port forwarding rates at the Black Sea port of Taman and a lack of capacity on Russian railroads to the east.

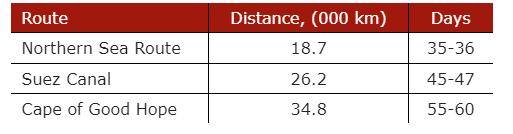

Freight rates from Ust-Luga to China via the North Sea Route are estimated at $43-45 per ton. In addition, the delivery time is 35 days compared to 45-47 days via the Suez Canal. And since the North Sea route is $5-6/ton cheaper than the Suez Canal, and the distance is shorter and safer, the supply of shipments via the North Sea route is likely to continue.

Distance and duration of voyage from Ust-Luga to China (Bohai Bay)

Although the North Sea route has limited sailing time without the assistance of icebreakers (from July to October), advantages over the route through the Suez Canal also include the exemption of ships from tolls and the absence of queues.

The advantages are even more pronounced compared to the route around the Cape of Good Hope, which is the longest and most expensive route ($6-7/tonne higher than the North Sea route).

In 2023, 36.2 million tons of goods were transported via the North Sea route, while by 2024 this figure is expected to reach 40 million tons, with oil and gas accounting for the largest share. The volume of coal transported via the North Sea route is expected to increase by the 2030s, which will also benefit from the development of coal deposits in Russia's northern regions.

Article Source:China Coal Economic Research Asscoiation